Now set at 4.5%, the Bank of England’s Monetary Policy Committee (MPC) has voted to cut the bank’s base interest rate.

What does this mean for you?

- The Bank of England has cut interest rates from 4.75% to 4.5%. The lowest base rate since June 2023

- The Bank’s Monetary Policy Committee voted 7-2 in favour of the cut. Interestingly, the two members wanted a bigger cut, to 4.25%.

- Cutting the rate makes borrowing cheaper and is intended to boost spending. But a lower rate means smaller returns for saving.

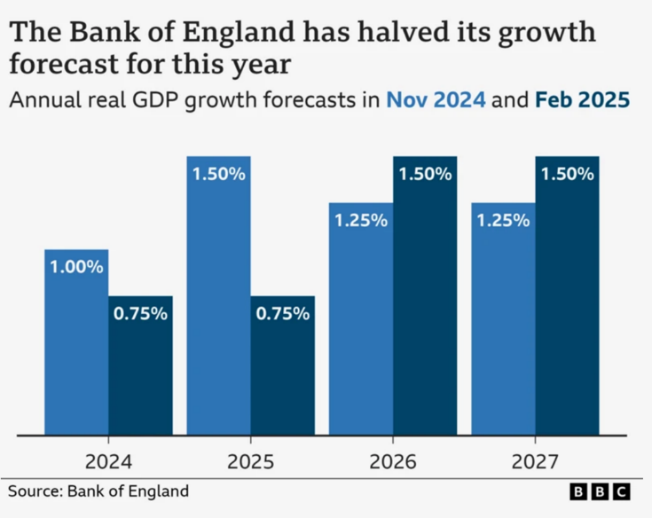

- The Bank also cuts its growth forecast for the UK economy in 2025 from 1.5% to 0.75%

Let’s take a closer look:

On 7th February 2024, economists on the bank’s MPC unanimously called for a cut in interest rates. They voted 7-2 in favour of the 0.25-point decrease, with those voting against preferring a 0.5-point cut.

The reduction in interest rates occurs despite inflation staying above the Bank of England’s 2% target, with CPI inflation at 2.5% for Q4 of 2024. The MPC believed domestic inflationary economic pressures, including wage growth, had slowed sufficiently to permit the cut.

However, economists have pointed out that inflation could rise to 3.7% by autumn 2025 due to increasing global energy costs. This new cut aims to bolster economic growth by enhancing credit availability. It’s projected that the GDP will only grow by 0.1 percentage points in the first three months of this year.

Excitingly, with all this news and the changes to the base rate, interest rates linked to the rate set by the Bank of England are already beginning to fall.

Alongside this, HM Revenue & Customs announced that its interest rates on late payments are also falling, thanks to legislation linking them to the Bank of England base rate.

New rates will take effect from 17 February 2025 for quarterly instalment payments and from 25 February 2025 for non-quarterly instalment payments. The late payment interest is currently set at the base rate plus 2.5%. Repayment interest is established at the base rate minus 1%, with a lower limit—or ‘minimum floor’—of 0.5%.

Are you ready to take advantage of these new cuts? Contact us today for updated mortgage advice.

Your Home (or property) may be repossessed if you do not keep up repayments on your mortgage or any other debts secured on it.